Hybrid Electric Car Salary Sacrifice

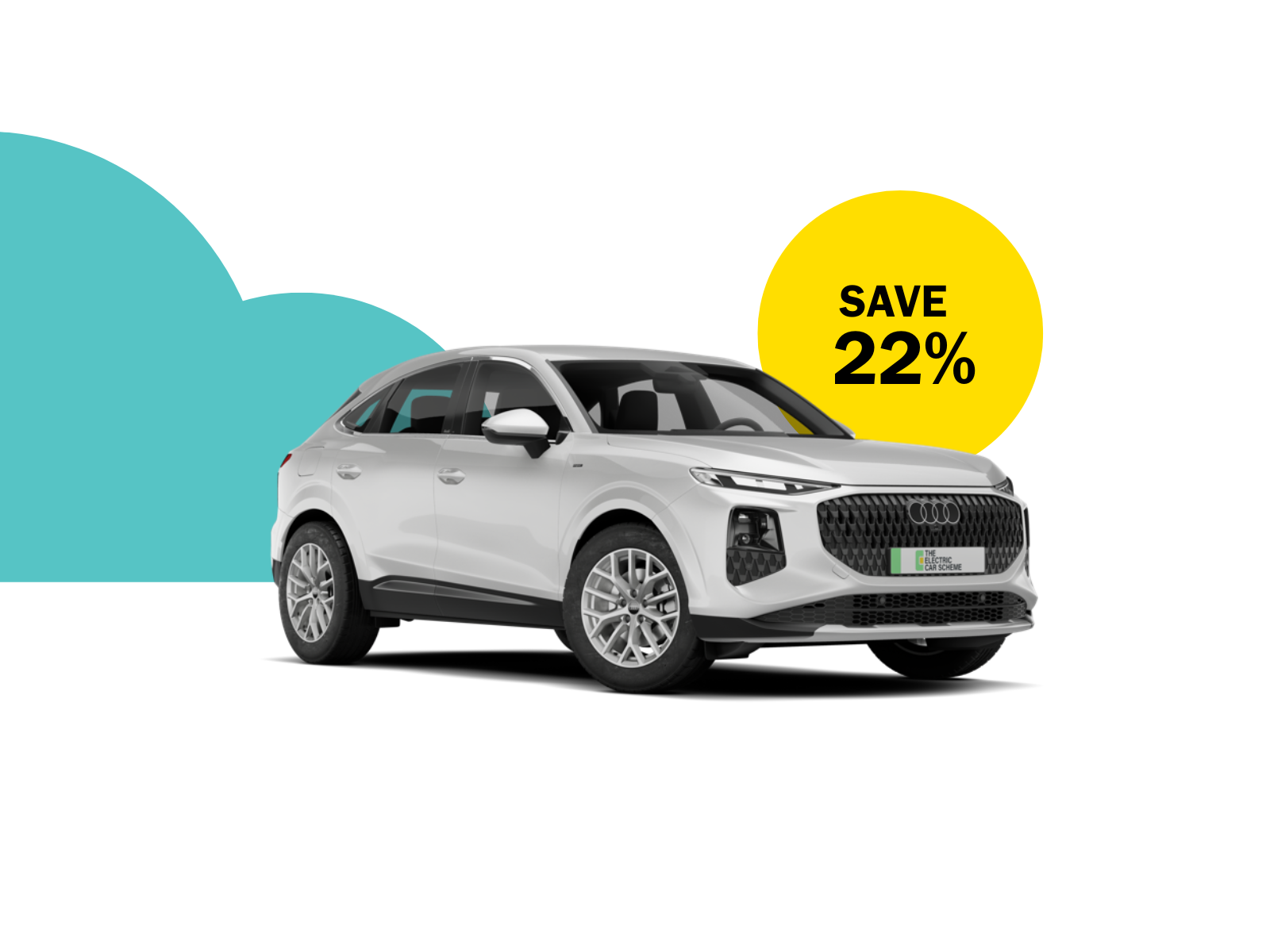

Save up to 30% on hybrid cars through salary sacrifice. Support more employees on their journey to Net Zero with plug-in hybrids that build confidence and momentum toward fully electric driving.

Why Salary Sacrifice A Hybrid Electric Car?

Broader Appeal

Open your scheme to more drivers and give more employees access to salary sacrifice savings. Hybrids are perfect for longer distance drivers or those not quite ready for fully electric, helping you drive higher participation and engagement.

Significant Savings

BiK rates as low as 6-20% vs 25-37% for traditional vehicles. Plug-in hybrids qualifying for our scheme attract dramatically lower tax rates than traditional cars. Employees still save meaningfully through salary sacrifice.

Smooth Transition

Give employees the confidence to start their electric journey with the backup of a petrol engine. Build charging habits, range confidence, and momentum toward your Net Zero goals without limiting driver choice.

Why We Offer Hybrids

While fully electric cars remain the most tax-efficient option, we know some employers want to include plug-in hybrids as a transitional step for employees who aren't yet ready to go fully electric. The Electric Car Scheme gives you that flexibility.

We've carefully selected plug-in hybrids that make financial sense in salary sacrifice - only models emitting 75g/km CO₂ or below with confirmed Euro 6e classification. This ensures employees get genuine savings and you avoid any surprises with BiK rates.

Whether your employees choose a hybrid or fully electric car, the process is exactly the same. The Electric Car Scheme provides the same package, support and service - from quoting through to delivery. If you're unfamiliar with salary sacrifice and want to understand how it can benefit your business, we suggest checking out our 'How it Works' page here.

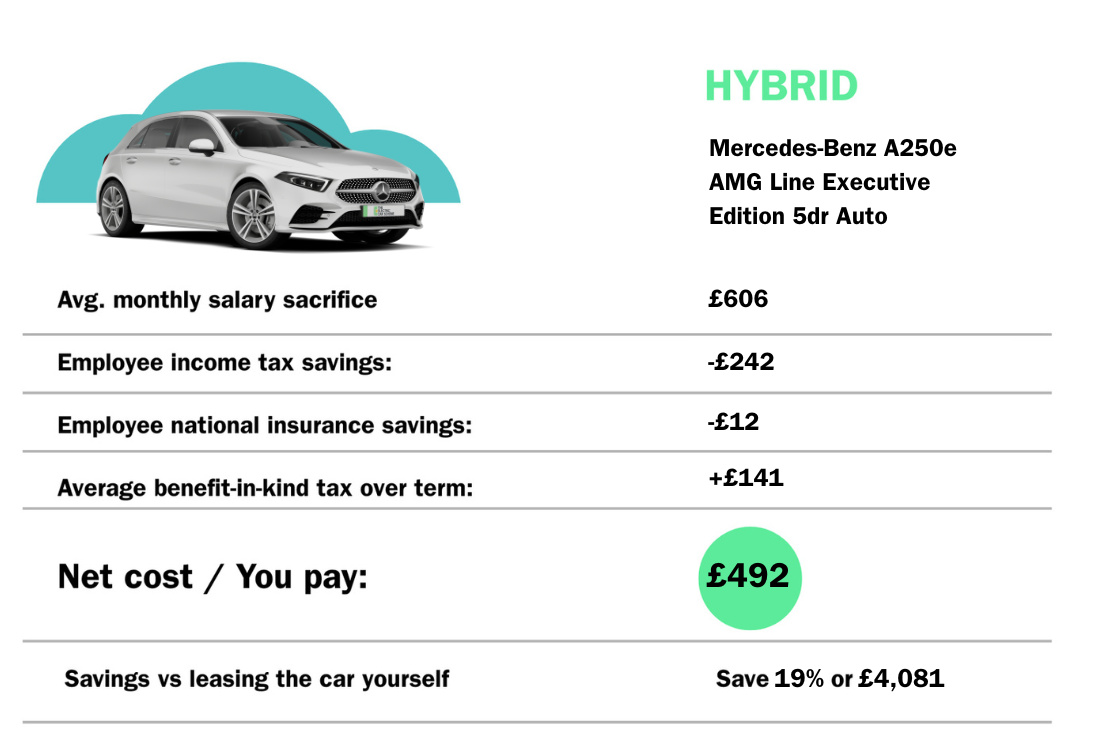

How Much Could I Save By Leasing A Hybrid Car?

Plug-in Hybrids and Benefit-in-Kind

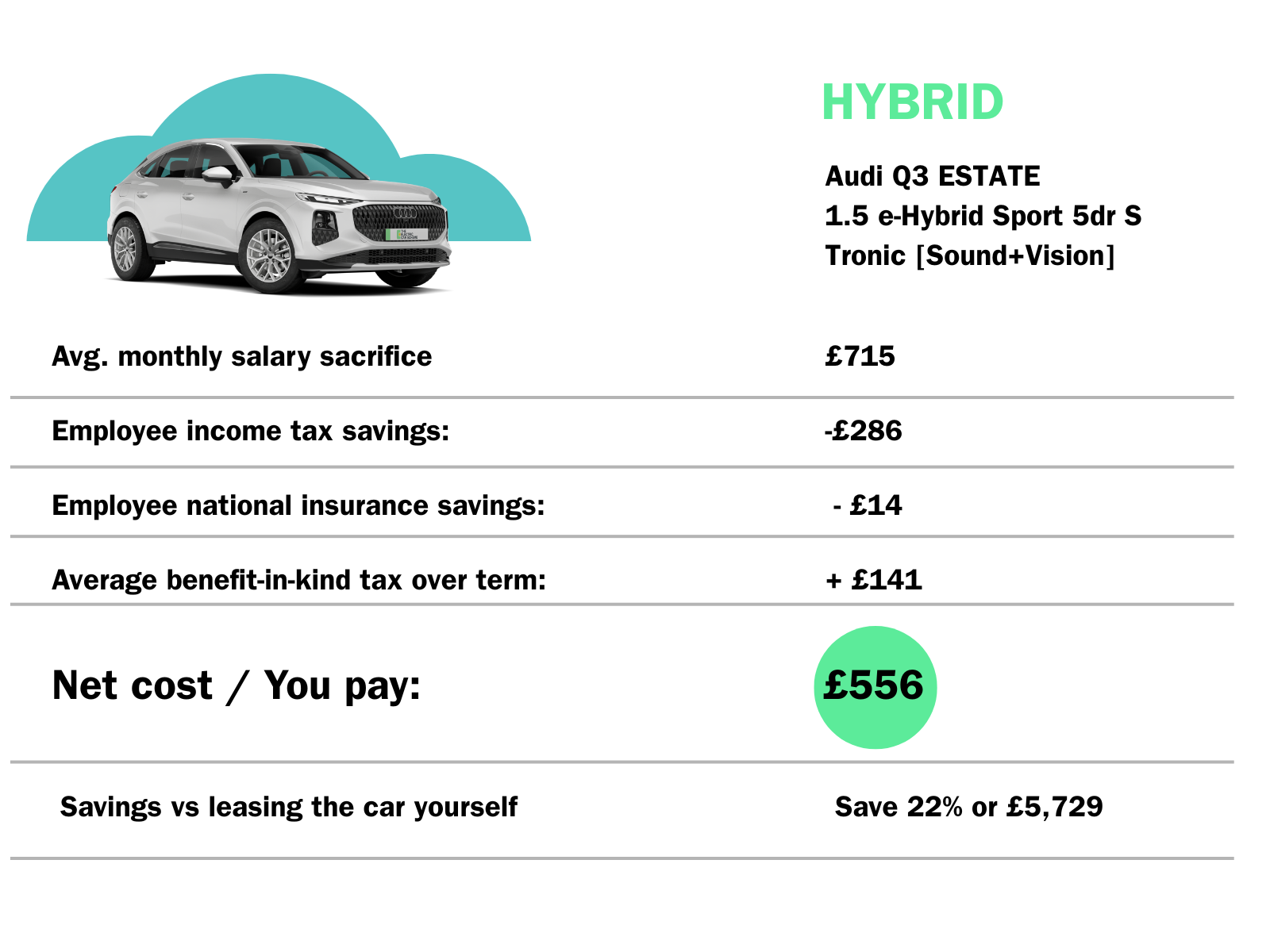

Plug-in hybrids offer a compelling middle ground between tax efficiency and driving flexibility. Models emitting up to 75 g/km CO₂ qualify for significantly lower Benefit-in-Kind (BiK) tax rates than petrol or diesel cars - as low as 6-20%, compared to 25–37% for traditional vehicles.

For example: A typical plug-in hybrid with 50 g/km CO₂ attracts an 8% BiK rate in 2025/26 - over three times cheaper in tax than a petrol equivalent.

At The Electric Car Scheme, we only offer PHEVs with 74g/km CO₂ or below, ensuring they deliver meaningful salary sacrifice savings while making a real environmental impact with sufficient electric range for daily driving.

How Hybrids Fit Into Our Salary Sacrifice Car Scheme

Eligibility and selection

We include plug-in hybrids that make financial sense in salary sacrifice and meet sensible emissions and electric range criteria. This avoids models that are unlikely to deliver a saving for your employees.

Payroll and compliance

Identical processes for approvals, payroll input, BIK and Class 1A NI reporting, and annual impact reporting on Scope 3 reductions.

Employee journey

Employees receive the same quoting, education and support as for electric cars, including charging at home, the office and in public through The Charge Scheme

Lease a Used Hybrid Car

Trusted By Companies Just Like Yours

Frequently Asked Questions

-

Yes. While fully electric is the most sustainable choice, adding low-emission plug-in hybrids lowers your average fleet emissions and helps bring more employees on the journey to Net Zero sooner.

-

No. Hybrids use the same onboarding, approvals, payroll inputs, and HMRC reporting as electric cars. Your account team and employer portal remain exactly the same.

-

Plug-in hybrids emitting up to 75 g/km CO₂ qualify for favourable BiK rates - typically 8–12% - compared to 25–37% for petrol or diesel cars.

This means employees can enjoy substantial savings through salary sacrifice, while your business benefits from lower fleet emissions and higher scheme engagement.

For example, a plug-in hybrid with 50 g/km CO₂ and a 60 km electric range would pay BiK at 8% in 2025/26 - more than three times cheaper in tax than its petrol equivalent.

-

Used electric cars from The Electric Car Scheme means the car has had one owner previously.

-

PHEVs (Plug-in Hybrid Electric Vehicles) have a large battery that can be charged at a plug point and can travel significant distances on electric power alone.

HEVs (Hybrid Electric Vehicles) charge their smaller battery through the engine and regenerative braking, offering only very short electric-only range.

MHEVs (Mild Hybrid Electric Vehicles) have a small electric motor that assists the engine but cannot drive the car independently.

We only offer PHEVs because they're the only hybrid type that qualifies for low BiK rates and delivers meaningful salary sacrifice savings.

-

We've set this emissions threshold to ensure employees get genuine salary sacrifice savings. PHEVs emitting 75g/km CO₂ or below qualify for BiK rates of 8-12%, compared to 25-37% for traditional petrol and diesel cars.

This emissions band also indicates the vehicle has sufficient electric range to make a real environmental impact when charged regularly.

-

Yes, absolutely. PHEVs (Plug-in Hybrids) can be charged using a standard domestic socket (though this is slower) or a dedicated home charge point for faster charging.

Most PHEVs fully charge overnight, giving you enough electric range for typical daily commutes. You can also charge at public charging stations. The more you charge, the more you'll drive on electric power and maximise your savings.

-

No. The Charge Scheme is only available for fully electric cars. With plug-in hybrids, we're unable to calculate which miles are driven on the battery versus the engine, making it impossible to accurately measure and reward electric driving.

This means hybrid drivers won't benefit from The Charge Scheme's incentives, but they'll still save significantly through salary sacrifice compared to traditional car ownership or petrol and diesel alternatives.

Latest Articles From Our Blog

Our blog is to provide readers with comprehensive information about the Electric Car Scheme, including its benefits, challenges, and the future of Net Zero. We cover a range of topics, from the technology behind electric cars and how they work, to the different models available on the market. Whether you're a seasoned electric car owner, or just starting to explore the possibilities of this exciting technology, this blog is the perfect resource for you.